- Just take the notorious Deutsche Bank (DB) that has outstanding derivatives of €37 trillion against total equity of €62 billion. Thus the derivatives position is 600X the equity.

- Or to put it in a different way, the equity is 0.17% of the outstanding derivatives. So a loss of 0.2% on the derivatives will wipe the share capital and the bank out!

- Fire, Fire! "It's Going To Be Carnage" - Deutsche Begins Culling 18,000 Employees.

The $2.3 Quadrillion Global Timebomb

Authored by Egon von Greyerz via GoldSwitzerland.com,

'Credit Suisse is hours from collapse and the consequences could be a systemic failure of the financial system'...

Disappointingly, my dream last night stopped there. So unfortunately I didn’t experience what actually happened.

As I warned in last week’s article on Archegos and Credit Suisse, investment banks have created a timebomb with the $1.5 quadrillion derivatives monster.

A few years ago, the BIS (Bank of International Settlement) in Basel reduced the $1.5 quadrillion (1024) to $600 trillion with a pen stroke. But the real gross figure was still $1.5q at the time. According to my sources, the real figure today is probably over $2 quadrillion.

A major part of the outstanding derivatives are OTC (over the counter) and hidden in off balance sheet special purpose vehicles.

LEVERAGED ASSETS JUST GO UP IN SMOKE

The $30 billion in Archegos derivatives that went up in smoke over a weekend is just the tip of the iceberg. The hedge fund Archegos lost everything and the normal uber-leveraged players Goldman Sachs, Morgan Stanley, Credit Suisse, Nomura etc lost at least $30 billion.

These investment banks are making casino bets that they can’t afford to lose. What their boards and top management don’t realise or understand is that the traders, supported by easily manipulated risk managers, are betting the bank on a daily basis.

Most of these ludicrously high bets are in the derivatives market. The management doesn’t understand how they work or what the risks are and the account managers and traders can bet billions on a daily basis with no skin in the game but massive potential upside if nothing goes wrong.

DEUTSCHE BANK – DERIVATIVES 600X EQUITY

But we are now entering an era when things will go wrong. The leverage is just too high and the bets totally out of proportion to the equity.

Just take the notorious Deutsche Bank (DB) that has outstanding derivatives of €37 trillion against total equity of €62 billion. Thus the derivatives position is 600X the equity.

Or to put it in a different way, the equity is 0.17% of the outstanding derivatives. So a loss of 0.2% on the derivatives will wipe the share capital and the bank out!

Now the DB risk managers will argue that the net derivatives position is just a fraction of the €37 trillion at €20 billion. That is of course nonsense as we saw with Archegos when a few banks let $30 billion over a weekend.

Derivatives can only be netted down on the basis that counterparties pay up. But in a real systemic crisis, counterparties will disappear and gross exposure will remain gross.

So all that netting doesn’t stand up to real scrutiny. But it is typical for today’s casino banking world when depositors, shareholders and governments take all the downside risk and the management all the upside.

So let us look at the global risk picture in the financial system:

BY TYLER DURDEN

BY TYLER DURDEN

The $2.3 quadrillion above is what the world is exposed to when this timebomb explodes.

That is the total sum of global debt, derivatives and unfunded liabilities. When all the dominos start falling, and no one can meet their obligations, this is what governments are left to finance.

Yes, they will print this money and much more as deficits mount exponentially due to collapsing currencies. But the MMT (Modern Monetary Theory) clowns will then find out that printed money rightfully has ZERO value.

If these clowns studied history they would learn that MMT has never worked. Just check the Roman Empire 180-280 AD, France in the early 18th century, or the Weimar Republic, Zimbabwe, Argentina and Venezuela in the 19th and 20th centuries.

So when Fiat money dies, how much gold is required to repair the damage?

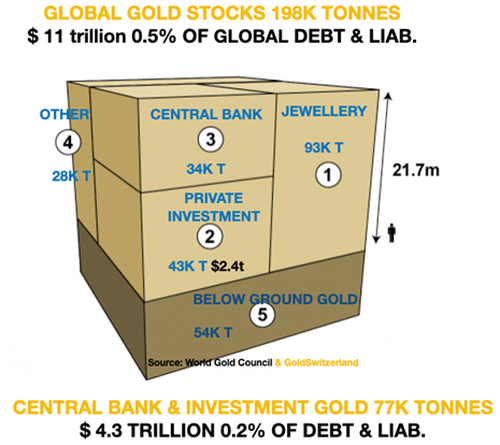

If we look at the cube below with all the gold ever produced in history, we see that it is 198,000 tonnes valued at $11 trillion.

Below the cube the total central bank and investment gold is shown. This amounts to 77,000 tonnes or $4.3 trillion. That sum represents 0.2% of the total debt and liabilities of $2.3 quadrillion as shown in the Timebomb.

The $4.3 trillion gold value is at a gold price of $1,750 per ounce. This minuscule 0.2% of liabilities obviously is far too small to support global debt. A 20% gold backing of total liabilities would be a minimum.

That would be 100X the current 0.2% or a gold price of $175,000.

I am not forecasting this level or saying that it is likely to happen. All I am doing is looking at the total risk that the world is facing and relating it to the only money that will survive.

Also, measuring the gold price in dollars serves no purpose because when/if this scenario happens, the dollar will be worthless and the gold price measured in worthless dollars at infinity.

FOCUS ON WEALTH PRESERVATION

Rather than focusing on a potential gold price measured in dollars, investors should worry about preserving their wealth in real assets held outside a bankrupt financial system.

Regardless of what price gold and silver reach, history proves that it is the ultimate form of wealth preservation.

It will not be different this time. Therefore, in the coming crisis, precious metals will be the best insurance to hold as protection against unprecedented global risk.

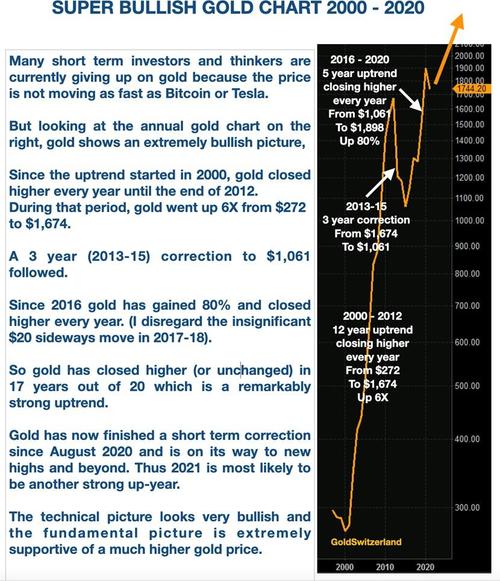

Gold’s rise since 2000 in no way reflects the massive money printing we have seen in this century.

Still as the graph below shows, gold is at the beginning of a very strong uptrend that has very far to go in both time and price.

Investors have the following choice:

Either they follow the coming crash in bubble assets like stocks, property and bonds all the way to the bottom which is likely to be 75-95% lower in real terms (measured in gold).

Or they protect their wealth in physical precious metals, stored outside a fractured financial system.

As always, history gives the answer as to which path to take.

https://www.zerohedge.com/markets/23-quadrillion-global-timebomb

__

Fire, Fire!

— Graviola Finland (@GraviolaDOTfi) July 8, 2019

"It's Going To Be Carnage" - Deutsche Begins Culling 18,000 Employees

At least 77% of the €206.9 billion loans by the Troika of the IMF, ECB were used to bail out creditors and recapitalise banks. https://t.co/sp5j61E1op pic.twitter.com/QiB6a58UYv

__

The European Super Highway of Debt

— Graviola Finland (@GraviolaDOTfi) May 27, 2020

- A lot of banks are "under water' with debt.

- These info-graphics shows how much banks borrowed to Portugal, Ireland, Italy, Greece & Spain (PIIGS) - the countries least likely to pay it back. https://t.co/PqLOPt1tzy pic.twitter.com/KzLxkYrkw0

__

Names of large numbers

https://en.wikipedia.org/wiki/Names_of_large_numbers

__

- The Niagara Falls use up a quadrillion gallons in a little over 210 years.

- The Great Lakes have a volume of about 6 quadrillion gallons.

- The universe is about 473 quadrillion seconds old.

- It is about 586 quadrillion miles from one end of the Milky Way to the other.[7]

- The SI prefix peta- multiplies by one quadrillion.

- 1,000,000,000,000,000 to 10,000,000,000,000,000 (1015 to 1016) – The estimated total number of ants on Earth alive at any one time (their biomass is approximately equal to the total biomass of the human race).

- 9,007,199,254,740,992 (253) – number until which all integer values can exactly be represented in IEEE double precision floating-point format.

- 48,988,659,276,962,496 is the fifth taxicab number.

- In Isaac Asimov's Galactic Empire, in what we call 22,500 CE there are 25,000,000 different inhabited planets in the Galactic Empire, all inhabited by humans in Asimov's "human galaxy" scenario, each with an average population of 2,000,000,000, thus yielding a total Galactic Empire population of approximately 50,000,000,000,000,000.

https://googology.wikia.org/wiki/Quadrillion

__