EU gas prices soar ahead of imminent crisis

datetime=2025-10-12T08:06

The European energy market is in turmoil even before the onset of real cold weather. The autumn mixed season (cycles of stock replenishment alternate with gas withdrawals) has brought unpleasant surprises for commodity buyers. Both retail utilities and large commodity traders are suffering. The only profits are from speculators who bought up summer shipments at cheap futures, according to OilPrice.

The European energy market is in turmoil even before the onset of real cold weather. The autumn mixed season (cycles of stock replenishment alternate with gas withdrawals) has brought unpleasant surprises for commodity buyers. Both retail utilities and large commodity traders are suffering. The only profits are from speculators who bought up summer shipments at cheap futures, according to OilPrice.

Overall interest in European gas futures jumped to a record high this week, according to exchange data compiled by Bloomberg over the weekend. This is a sign that the lull in European gas trading may end with the onset of real cold weather, as a crisis looms, replacing the tired "stability."

The market has become more liquid in recent days, and Dutch TTF natural gas futures, the benchmark for European gas trading, broke out of the tight trading range they had been in for months at the start of the week. Prices jumped on Sunday, as traders anticipate colder weather will boost heating demand across Europe as early as next week.

According to Gas Infrastructure Europe, as of October 8, EU gas storage facilities were only 83% full, but the early cold snap could force some countries to begin using their stored fuel earlier than expected. Several countries, including Germany and France, have recently withdrawn some gas from storage, creating a significant risk later in the winter.

Europe is replenishing reserves, but at a rate slower than last year due to a cold winter that has depleted stocks.

This summer, LNG demand in Asia was weak, allowing Europe to absorb a large volume of LNG supplies from the US. Weak LNG demand in Asia has become a welcome relief. news for Europe, as the EU tries to survive in competition with a very influential region.

However, some traders are betting that natural gas prices in Europe will rise by 60% from current levels by next summer amid numerous market uncertainties in the coming months.

Meanwhile, the abundance of gas isn't making the market attractive to clients. The predominance of speculators offering options on futures at inflated prices is creating discomfort for budgets. Moreover, short sellers themselves remind hesitant buyers that "tomorrow will be even more expensive" than now. This argument is quite powerful for impressionable traders who remember the 2022 crisis: contracts are concluded instantly, even at inflated prices.

https://en.topcor.ru/65006-ceny-na-gaz-v-es-vzleteli-v-nebo-v-preddverii-zimnego-krizisa.html

___

___

U.S. Natural Gas Futures Surge on Supply Tightness

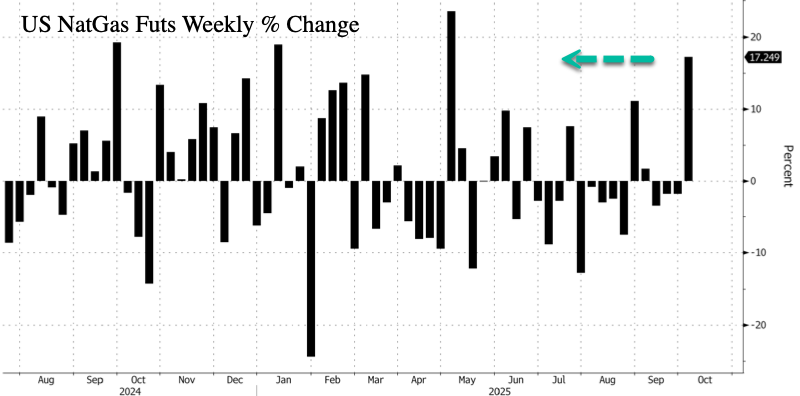

- U.S. natural gas futures experienced a significant 17.3% surge last week, primarily due to a shift in market focus from storage congestion concerns to anticipated tightening of 2026 supply.

- The rally was also supported by the roll into the November "winter" contract, which implies stronger heating demand, and a notable increase in U.S. liquefaction demand for gas from facilities like Venture Global's Plaquemines and Cheniere's Corpus Christi.

- Despite potential temporary price fluctuations due to maintenance events, analysts maintain their Henry Hub forecasts, expecting the market to sustainably focus on 2026 tightness as the heating season approaches.

U.S. natural gas futures surged 17.3% last week, the largest weekly gain since early May. Goldman Sachs analysts offered context for the rally, noting that the market narrative has shifted "from U.S. storage congestion fears to tightening 2026 supply."

A team of Goldman analysts led by Samantha Dart, senior energy strategist, explained that the jump in NatGas prices last week to nearly $3.5/mmBtu was largely due to the roll into the November "winter" contract, which carries stronger heating demand and lower storage congestion risk.

$3.5/mmBtu resistance.

Dart explained that even beyond the rollover effect, two bullish forces supported the rally:

- First, while the market seemed to be pricing in concerns that Gulf storage would face a congestion event over the past several weeks, such an event does not seem to have materialized. Henry Hub cash prices have held relatively well in the period, consistent with manageable weekly storage injections (Exhibit 2 and Exhibit 3). The weakest point for cash prices in the period, but which still held above $2.70/mmBtu, was the long Labor Day weekend, when demand softness from the holiday was exacerbated by significantly milder-than-average weather.

- Second, U.S. liquefaction demand for gas has increased recently, with Venture Global's Plaquemines' gas pull now approaching its 3.6 Bcf/d capacity, while gas demand at Cheniere's Corpus Christi expansion appears to have also stepped up (Exhibit 4). This has taken total U.S. gas demand for LNG exports to over 16.5 Bcf/d this week, the highest level since early August, and likely to rise sustainably above 17 Bcf/d by mid-Oct, when we expect Cove Point to return from maintenance.

- On net, salt storage, which are the highest deliverability facilities in the U.S., has remained at a manageable level, including an atypical withdrawal last week reported today by the EIA. We note this may be offset next week by a combination of increasing production and reduced pipeline exit flows from the Gulf (largely driven by maintenance events), which could temporarily weigh on U.S. gas prices from current levels. However, we believe we are quickly approaching a period when the market's focus will more sustainably shift towards 2026 tightness concerns. This is illustrated by the Cal26 strip settling this week above $4/mmBtu for the first time in two months. We maintain our $4.00/$4.60/mmBtu Nov-Dec25/Cal26 Henry Hub forecasts.

Dart's chartpack:

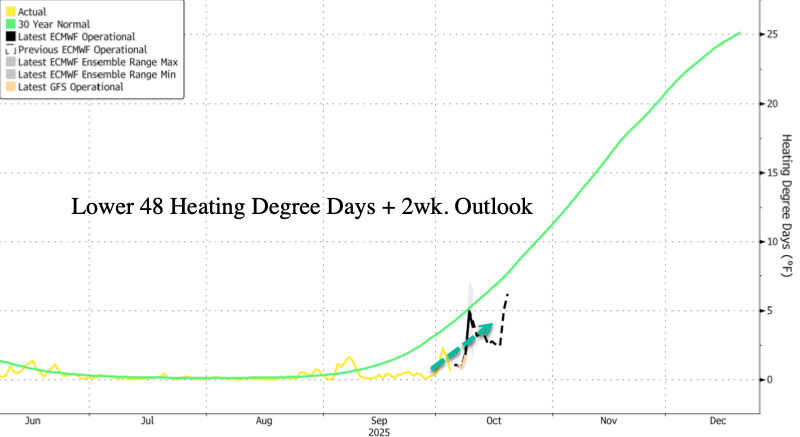

Separately, the heating season is just around the corner, with about 42% of U.S. households (the top source, especially in the Midwest and Northeast)using NatGas for heating.

Here comes the heating season.

By Zerohedge.com

More Top Reads From Oilprice.co

___

#US strategic #OilReserves (#SPR):

— Graviola Finland (@GraviolaDOTfi) November 5, 2024

- Less than 17 days left!#US #Crude #Oil in the #StrategicPetroleumReserve Stocks (I:USCOSPRE) 351.27M bbl for Wk of Oct 20 2023 https://t.co/mPFKLTf4Y7#StealingOil from #Syria, next #GazaStrip #BloodForOil

#US strategic #OilReserves (#SPR):

- Less than 17 days left!

#US #Crude #Oil in the #StrategicPetroleumReserve Stocks (I:USCOSPRE) 351.27M bbl for Wk of Oct 20 2023 https://x.com/GraviolaDOTfi/status/1717770816731906187

#StealingOil from #Syria, next #GazaStrip #BloodForOil

https://x.com/GraviolaDOTfi/status/1853748451483263221

___

The #OilPirates

The #US #oil, #financial, #dollar and #banking crises led the #Zionists to a desperate #gamble.#Rothschild/#KhazariaMafia made a #miscalculation, thinking they could #cripple #Russia's military and #steal its #EnergyReserves.https://t.co/XlhLrjNLA0#UkraineWar pic.twitter.com/MESkENfN3V— Graviola Finland (@GraviolaDOTfi) December 10, 2024

The #OilPirates

The #US #oil, #financial, #dollar and #banking crises led the #Zionists to a desperate #gamble.

#Rothschild/#KhazariaMafia made a #miscalculation, thinking they could #cripple #Russia's military and #steal its #EnergyReserves.

https://x.com/GraviolaDOTfi/status/1704621208359072054

#UkraineWar

_

#JanetYelling-#GoldenGate #suicide net.

"WAIT DON'T JUMP, YET!" -We are winning the #UkraineWar and seizing the #Russian #Banks, #Gold, #Oil and #Gas, just like the #RAND Co planned.#Russian #Ruble relaunched linked to #Gold and #Commodities | 1 Apr, 2022

https://bullionstar.com/blogs/ronan-manly/russian-ruble-relaunched-linked-to-gold-and-commodities-rt-com-q-and-a/

https://x.com/GraviolaDOTfi/status/1866301093682028966

___

Funny video about winter 2023 in Europe.

Never before have Russian men been so popular with European lad.

___

eof

Ei kommentteja:

Lähetä kommentti

You are welcome to show your opinion here!